Tax Knowledge Library

An innovative digital learning platform for taxation

The Tax Knowledge Library is a digital learning platform that covers fundamental, internationally applied concepts of taxation. It consists of a collection of more than 30 short explanatory videos and over 270 quiz questions in English.

How do students benefit?

Learn and review content

- Short videos on basic concepts of taxation

- Ideal for learning, reviewing content, and closing knowledge gaps

Test your knowledge

- Theoretical and applied quiz questions

- Suitable for testing knowledge and identifying knowledge gaps

What can lecturers expect?

Support students effectively

- Reinforce recently acquired knowledge

- Bring students up to a common level of knowledge

- Diverse question formats and complexity levels

Flexible & free learning material

- Digital learning materials available anytime

- More than 30 videos and over 270 quiz questions on tax concepts

- Suitable for Bachelor and Master courses

International applicability

- Internationally applicable tax concepts

- No country-specific elements

- English language

Content

The Tax Knowledge Library includes five modules with a total of 32 videos and 35 quizzes. The modules cover:

1. Fundamentals of Taxation

- Objectives of Income Taxation

- Types of Taxes

- Ideal Tax System

- Elements of a Tax

- Income Tax Collection

2. Business Taxation

- Taxation of a Sole Proprietorship

- Taxation of a Corporation

- Taxation of a Partnership

- Taxation of a Subsidiary

- Taxation of a Permanent Establishment

- Taxation of a Subsidiary vs. Permanent Establishment

- Group Taxation

- Taxation of Intercompany Dividends

- Overview of Corporate Tax Systems

- Double Taxation Reducing Corporate Tax Systems

- Double Taxation Avoiding Corporate Tax Systems

- Local Business Taxes

3. Income Determination & Interaction with Accounting

- Determination of Taxable Profits

- Tax Treatment of Losses

- Taxation of Capital Gains

- Deferred Taxes

4. International Taxation

- Taxation of Cross-Border Investments

- Credit Method to Relief International Double Taxation

- Exemption Method to Relief International Double Taxation

- Credit vs. Exemption Method

- Capital Import Neutrality and Capital Export Neutrality

- Tax Treaties

5. Tax Planning

- Tax Strategies

- Net Present Value

- Impact of Taxes on the Net Present Value

- Introduction to Financing

- Tax Implications of Equity Financing

- Tax Implications of Debt Financing

- Tax Implications of Equity vs. Debt Financing

- Intercompany Transactions and Transfer Pricing

In total, the Tax Knowledge Library contains more than 270 quiz questions in various formats, such as multiple or single choice, drag and drop, or fill in the blanks.

Access

If you are a member of the University of Mannheim, you can access the course “Tax Knowledge Library” via the digital learning platform ILIAS. Lecturers can also integrate a link to the Tax Knowledge Library into their own courses. You can find the course in ILIAS.

Not a member of the University of Mannheim? You can integrate the Tax Knowledge Library into your own digital learning platform, provided it supports H5P. The Tax Knowledge Library consists of H5P elements that can be exported and imported. Each of the five modules is an interactive book containing the videos and the corresponding quiz questions as separate pages. If your platform supports H5P, you can import the H5P modules that we provide to you. A web browser is all you need to view or edit H5P elements. The content is accessible via laptops and various mobile devices.

All videos included in the Tax Knowledge Library are also publicly available in the Tax Video Library.

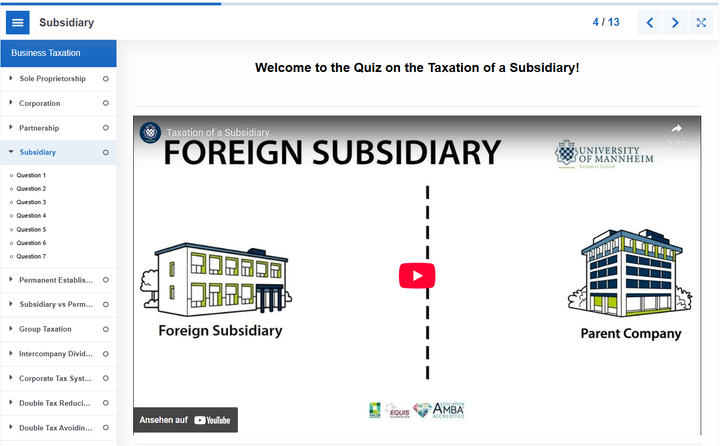

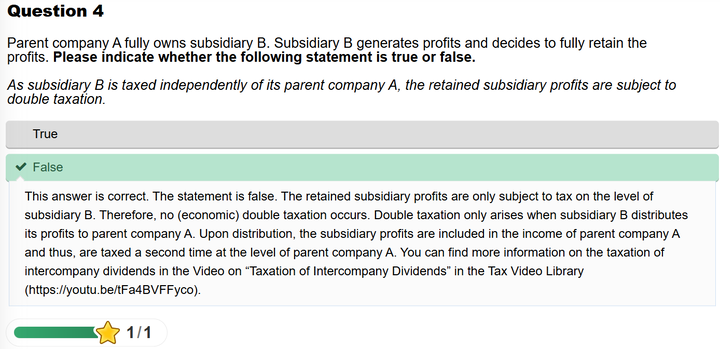

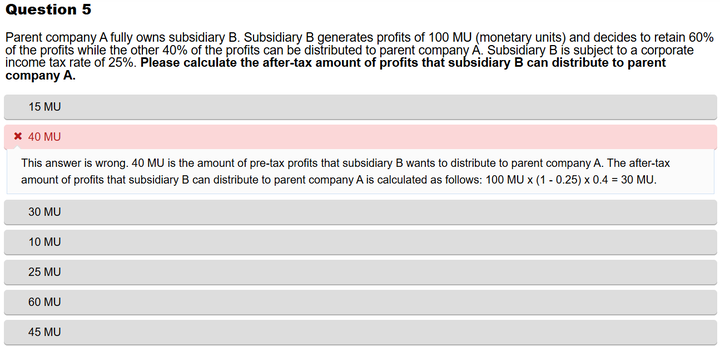

Preview

Curious to see what the Tax Knowledge Library looks like? Below is a sneak peek of the topic “Taxation of a Subsidiary” from the module “Business Taxation.”

Funding

The project for developing the Tax Knowledge Library was funded by the Stiftung Innovation in der Hochschullehre and Lehre@ENGAGE.EU.

Contact

If you have any questions, suggestions or feedback, please do not hesitate to contact us. You'll find our contact details below.

We would like to give a special thanks to our former student assistants, who made a significant contribution to the success of the project. We are also pleased to include the explanatory videos created by our (former) colleagues Dr. Sarah Winter and Inga Schulz.

Emilia Gschossmann, M.Sc.

E-Mail: emilia.gschossmannuni-mannheim.de

Phone: +49 (0) 621 – 181 1685

Address: Universität Mannheim

Schloss Ostflügel (Room 248)

68131 Mannheim

Hannah Gundert, M.Sc.

E-Mail: Hannah.Gundertzew.de

Address: Universität Mannheim

Schloss Ostflügel

68131 Mannheim