Finance Seminar Matti Keloharju

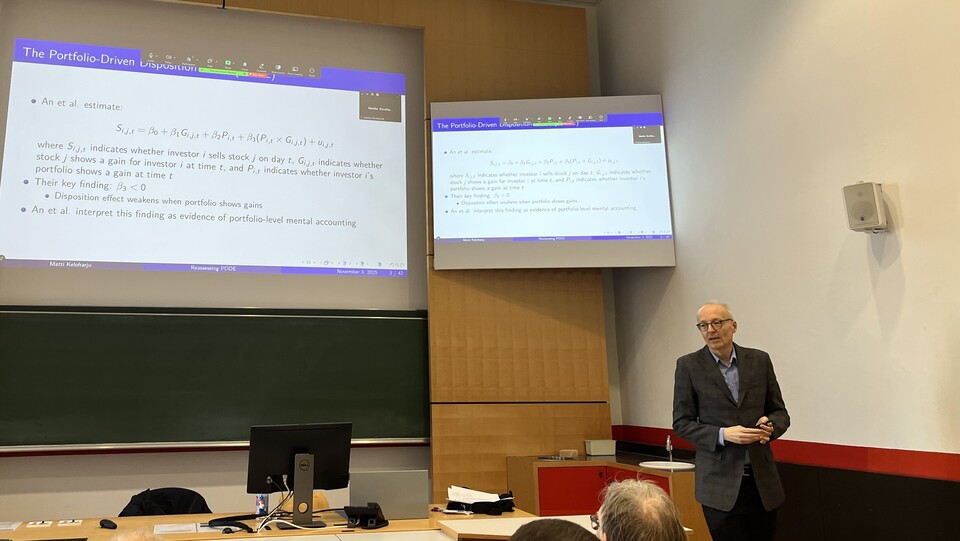

In this week’s Matti Keloharju from Aalto University presented the paper titled “Reassessing the Portfolio-Driven Disposition Effect”

The paper revisits one of behavioral finance’s most discussed patterns — investors’ tendency to sell winners too early and hold on to losers — and asks how much of it truly reflects investor psychology versus statistical structure.

This paper shows that what looks like portfolio-level behavior can emerge mechanically as investors’ own trading histories accumulate. By analyzing investor accounts and experimental data, they find that patterns in portfolio status and selling decisions often arise endogenously from past trades, rather than from active mental accounting.